2024 CRS and FATCA Reporting Season: Insights and Strategies

The onset of the 2024 reporting season marks a critical period for financial institutions worldwide as they navigate the complexities of complying with the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA). These regulations, designed to combat tax evasion and promote transparency in financial dealings, impose stringent reporting requirements.

As international financial regulations evolve, staying up-to-date on these changes is not just a matter of legal compliance but also of strategic importance for financial institutions. The implications of CRS and FATCA extend beyond mere reporting; they influence operational practices, client relationships, and technology infrastructure.

Our discussion will cover the latest regulatory updates, common reporting challenges, the pivotal role of technology in compliance, best practices for effective reporting, and a forward-looking perspective on the future of international financial compliance. By understanding these key areas, financial institutions can better prepare for the demands of the 2024 reporting season and beyond.

What are the updates and changes in CRS and FATCA for 2024?

The 2024 CRS and FATCA reporting season introduces several significant updates that financial institutions must be aware of. For instance, four jurisdictions committed to their first CRS exchange this year. These are Georgia, Kenya, Moldova, and Ukraine.

These changes reflect the ongoing efforts of regulatory bodies to refine and enhance the effectiveness of international tax compliance. One of the key challenges in adapting to these changes is ensuring that internal systems and procedures are flexible and robust enough to accommodate them. This might involve investing in new technology, software updates, or revisiting existing compliance workflows. Failure to adapt to these changes can result in non-compliance, which carries significant financial and reputational risks.

What are the common challenges in CRS and FATCA reporting?

Navigating CRS and FATCA reporting is often challenging due to the complexity and diversity of requirements across different jurisdictions.

Identifying reportable accounts

One common challenge is accurately identifying and classifying reportable accounts, which involves understanding and applying various criteria defined by multiple tax authorities. This process is further complicated by the need to handle large volumes of data, often from disparate sources.

Data accuracy

Another significant challenge is ensuring data accuracy and completeness. Inaccurate or incomplete data can lead to non-compliance, resulting in penalties and reputational damage. Financial institutions must establish robust data collection, verification, and management processes. This often involves cross-departmental coordination and a clear understanding of the data requirements set forth by CRS and FATCA regulations.

Regulation updates

Additionally, staying updated with the ever-changing regulatory landscape is a continual challenge. Regulations are frequently updated, and new guidance is regularly issued. This requires financial institutions to maintain a dynamic approach to compliance, with regular reviews and updates to their reporting processes. Implementing a culture of compliance throughout the organization and ensuring that all staff know their responsibilities is crucial for meeting these challenges.

How can technology be used to simplify compliance?

In the realm of CRS and FATCA compliance, technology is a game-changer. Advanced fintech solutions, such as those provided by Trans World Compliance (TWC), streamline and automate many aspects of the reporting process, reducing the likelihood of human error and enhancing overall efficiency. By leveraging technology, financial institutions can more easily navigate the complexities of CRS and FATCA reporting.

Essential technological tools include automated data collection systems, which can aggregate and organize data from various sources, and validation software, which ensures that the data meets the required standards of accuracy and completeness. Reporting tools can then format this data according to the specific requirements of different jurisdictions, a process that would be incredibly time-consuming and prone to error if done manually.

TWC's principle of simplicity in software design means that we offer solutions that demystify the compliance process. By automating complex tasks with fully secure transactions, our software reduces the manual effort required in CRS and FATCA reporting. This approach not only streamlines the compliance process but also minimizes the potential for human error, a critical factor in maintaining accuracy and reliability in reporting.

What are the best practices for CRS and FATCA reporting in 2024?

Effective CRS and FATCA reporting in 2024 begins with early and thorough preparation. Institutions should start their reporting process well before deadlines to ensure sufficient time for data collection, verification, and addressing discrepancies. This proactive approach can significantly reduce last-minute pressures and potential errors.

Regular internal reviews and updates of compliance processes are also critical. This includes staying informed about the latest regulatory developments, ensuring that all reporting systems are up-to-date, and conducting training sessions for staff involved in the reporting process. A vital aspect of this is fostering a culture of compliance within the organization, where every team member understands the importance of their role in the reporting process.

Conducting internal audits is another effective practice. These audits can identify potential compliance gaps and areas for improvement in the reporting process. By simulating the external auditing process, institutions can better prepare for actual regulatory audits and reduce the likelihood of non-compliance. Additionally, seeking feedback from external experts or peer institutions can provide valuable insights and best practices that can be adopted.

What does Canada, Curaçao and Luxembourg’s XML look like?

The Common Reporting Standard (CRS) is neither common nor standard for domestic reporting. Different local requirements will challenge a financial group that must fulfill reporting in multiple jurisdictions. Canada, Curaçao, Aruba, and Luxembourg are notable for their distinct financial regulation and reporting approaches. Understanding these regions' specific requirements and legal landscapes is essential for accurate reporting and compliance.

For Canada, the XML must include a T619 wrapper; for Curaçao, in one XML, both FATCA and CRS codes can be used by financial institutions; and for Luxembourg, you need to know the provider you need for submission, and you need to add other specific information in the wrapper. Not to mention the Netherlands, where the XML schema is in Dutch.

Canada has a unique <XML> including a "wrapper" for all electronic tax reports (A <T619> element), which includes FATCA and CRS XML and must contain Transmitter information. The account information in the XML also differs from the "normal" CRS schema.

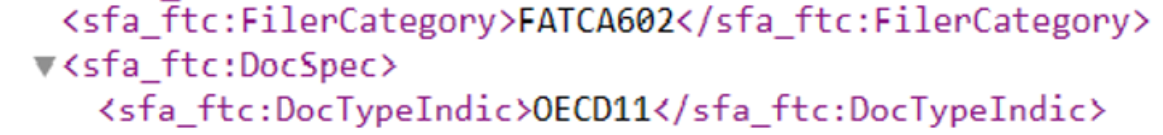

Curaçao uses the MDES portal for its CRS and FATCA data—the same XML for both FATCA and CRS, using local TIN and GIIN for reporting. And you may kind of mix and match FATCA and CRS codes in one XML.

Curaçao uses the MDES portal for its CRS and FATCA data—the same XML for both FATCA and CRS, using local TIN and GIIN for reporting. And you may kind of mix and match FATCA and CRS codes in one XML.

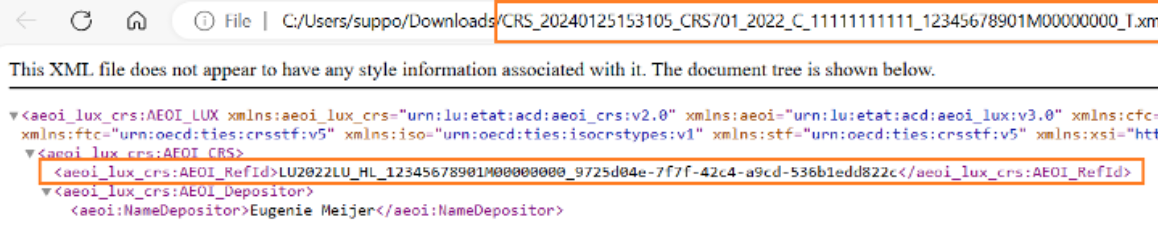

In Luxembourg, they love complex structures. The name filing alone for the XML submission has a complicated mandatory structure. Then, the financial institution must comply with compulsory structures, using either HL, HF, RF, SP, IN, AR, or PR in the <AEOI_RefId> <MessageRefId> and <DocRefId> depending on the kind of report.

In Luxembourg, they love complex structures. The name filing alone for the XML submission has a complicated mandatory structure. Then, the financial institution must comply with compulsory structures, using either HL, HF, RF, SP, IN, AR, or PR in the <AEOI_RefId> <MessageRefId> and <DocRefId> depending on the kind of report.

Our CRS/FATCA One solution can be configured with your Canada T619 information and handle the difference from the "normal" CRS schema. We can also mix and match FATCA and CRS codes into one XML.

Our CRS/FATCA One solution can be configured with your Canada T619 information and handle the difference from the "normal" CRS schema. We can also mix and match FATCA and CRS codes into one XML.

If you have no idea what we are writing about or are scratching your head about managing this, feel free to contact us for a free demo or trial. We have yet to mention the AEOI declarer, reporting person, and identifier!

What are the 2024 CRS and FATCA reporting deadlines?

Please note that these deadlines are subject to changes by the local tax authority.

January

Honduras is due to report FATCA on the 31st of January.

March

By the 31st of Marcha, Curaçao and Belize must report CRS and FATCA, and Turks and Caicos must exchange CRS. Additionally, all model 2 IGA and non-IGA countries must report FATCA.

April

Aruba and Japan have their CRS deadlines on the 30th of April, while Malta must report CRS and FATCA by the same date.

May

Canada starts the month by having to exchange CRS and FATCA on the 1st of May. On the 31st of May, the following countries also have their CRS and FATCA deadlines: Bahrain, the British Virgin Islands, Anguilla, India, Jamaica, Singapore, Spain, the UK, and South Africa. Additionally, Portugal, Colombia, Russia, Nigeria, and Bermuda must comply with CRS by the same date. Ecuador, on the other hand, has its deadline from the 10th to the 28th.

June

By the end of the month, 30th of June, Argentina, Chile, China, Switzerland, Taiwan, and Ghana must report CRS. Croatia, New Zealand, Montserrat, Luxembourg, Jersey, Isle of Man, Guernsey, Bulgaria, and Belgium must also comply with CRS by the 30th of June as well as FATCA. Finally, Turks and Caicos and Saint Lucia also have their FATCA deadline on this date.

July

Belgium has its CRS deadline on the 20th of July. Colombia has its FATCA deadline on the 27th of July, and Portugal has it on the 31st of July. By the 31st of July, Australia, the Cayman Islands, Costa Rica, France, Germany, Gibraltar, Liechtenstein, Mauritius, Panama, and St. Vincent & the Grenadines must report CRS and FATCA. Meanwhile, Austria, Pakistan, and Saint Lucia only have their CRS deadline on the 31st of July.

August

The Netherlands must report CRS and FATCA by the 2nd of August, Antigua by the 15th of August, the Bahamas by the 23rd of August, and Mexico by the 31st of August.

September

Trinidad has its CRS and FATCA reporting deadline on the 15th of September.

How does the future of compliance reporting look?

The future of CRS and FATCA reporting is likely to see increased regulatory rigor and a greater reliance on technology. As international efforts to combat tax evasion intensify, financial institutions can expect more stringent enforcement of compliance requirements. This could include more detailed reporting requirements, increased audit frequency, and higher penalties for non-compliance.

Emerging technologies like artificial intelligence (AI) and blockchain are poised to transform compliance processes significantly. AI can enhance data analysis, identify patterns indicative of non-compliance, and automate complex decision-making processes. Blockchain technology offers a secure and transparent way to store and share information, greatly aiding compliance efforts.

Financial institutions should invest in scalable compliance solutions and foster a culture of continuous learning and adaptation to stay ahead in this evolving landscape. They should also engage in industry forums and collaborations to keep informed about best practices and emerging trends. By doing so, they can comply with current regulations and be well-prepared for future developments in the compliance domain.

Conclusion

The 2024 CRS and FATCA reporting season presents challenges and opportunities for financial institutions. Institutions can effectively navigate this complex landscape by understanding the latest regulatory updates, addressing common reporting challenges, leveraging technology, and following best practices. Remember, investing in compliance is not just a regulatory requirement but a strategic imperative that can safeguard an institution's reputation and future.

We invite you to explore our solutions to streamline your CRS and FATCA reporting processes. For more information or to schedule a demo, please get in touch with us. Your feedback and queries are always welcome as we strive to support you in this vital aspect of financial compliance.